How Boarders and Flatmates Can Help You Buy Your First Home in New Zealand

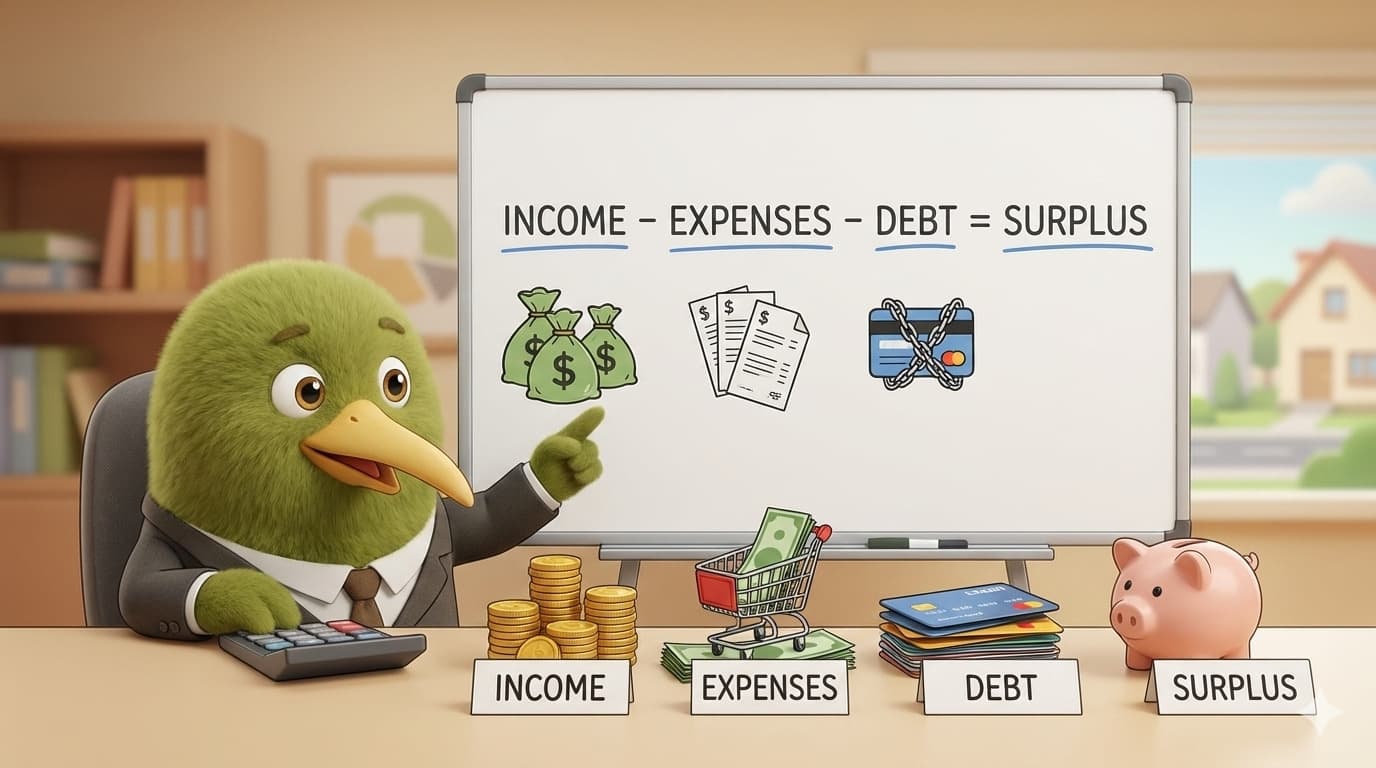

Including boarders or flatmates in your first home can materially improve your home loan affordability and ongoing cash flow, helping bridge the gap between renting and owning in New Zealand's challenging property market.

Read More →